Is now the right time to buy smaller companies?

Tim Richardson CFA, Investment Specialist

Smaller companies often outperform the broader market when interest rates start falling. They generally benefit more than larger caps from lower borrowing costs and are more nimble in seizing growth opportunities in a changing macro environment. Australian retail investors currently have an opportunity to access fast growing global smaller companies at unusually attractive valuation levels.

“Great things are done by a series of small things brought together.”

– Vincent Van Gogh

What has happened to smaller companies?

Our previous article explained how an allocation to smaller companies adds to portfolio diversification and enhances long-term risk-adjusted return potential. We now consider if this is a good time to increase small cap exposure.

Broader global share markets have recovered strongly since the start of 2023. However, small caps have underperformed because of:

- A perception of greater earnings risk due to more concentrated revenue streams

- Concerns around ability to raise further financing on reasonable terms

- Less liquid markets experiencing greater volatility

- Higher country/currency risk reflecting smaller companies’ domestic orientation

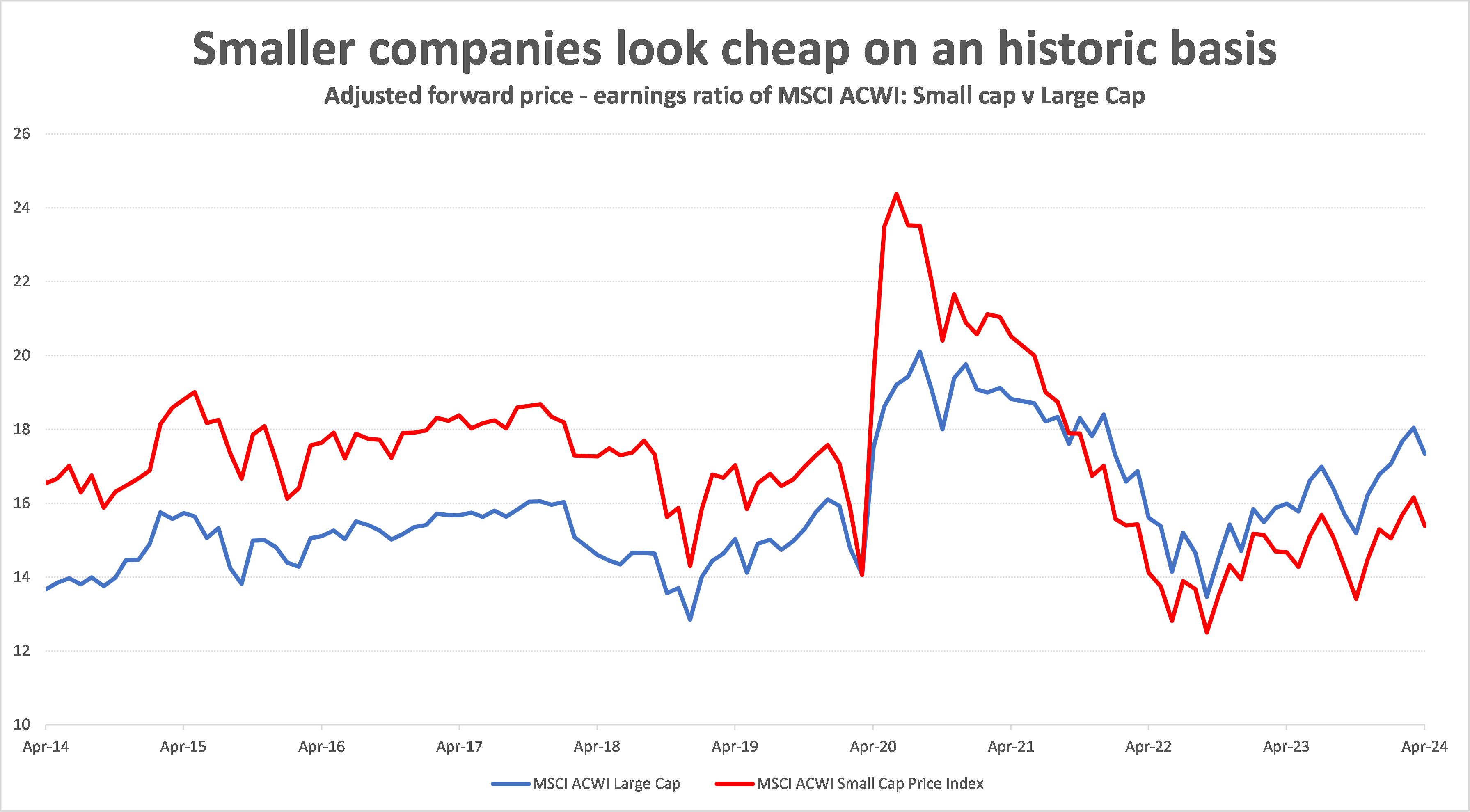

Nonetheless, the underlying businesses of many smaller company stocks – including those at the smaller end of the size spectrum – have been quite resilient. Some are nimble enough to adjust their cost base to the evolving economic environment and exploit new opportunities to grow earnings. Others have performed poorly. So it is important for investors to differentiate between companies when investing in small caps. However, small cap stocks overall now appear extremely attractively valued compared to larger caps:

Source: Bloomberg

The current discount of small caps relative to larger companies is one of the widest since the 2008 GFC, after which time smaller companies experienced a sustained period of outperformance.

While equity markets are expected to remain volatile for some time, ongoing earnings growth is providing support to share prices. However, smaller companies have continued to lag larger cap stocks. Inflation now appears to be falling back to target, leading many investors to expect major central banks to start cutting rates over the coming months. Smaller company stocks tend to outperform at this stage of the market cycle as investors return to the sector.

Which smaller companies can perform well in 2024?

Small cap stocks can be expected to deliver a wide dispersion of returns. Stocks able to perform strongly at this stage of the market cycle are those which manage inventories, control costs and grow earnings despite continued economic uncertainty.

Large cap technology company valuations have bounced back strongly over recent quarters, although smaller tech groups have not fully participated in this recovery. Businesses able to grow profits despite uncertain consumer spending are expected to perform strongly.

These include business models with largely fixed costs that serve less-cyclical, but fast growing markets, such as IntegraFin, the UK investment platform for financial advisers. Similarly, software companies such as Israel-based Sapiens International, which provides cloud-based applications for the global insurance market is benefiting as it integrates AI-features and transitions to a subscription model.

Consumer businesses which focus on premium cohorts less sensitive to higher interest rates are also growing earnings as global travel resumes. UK-based online package holiday operator On the Beach will have the opportunity to further grow volumes when lower interest rates ease the pressure on household budgets.

Smaller companies can provide attractive exposure to faster growing emerging markets which are benefitting as manufacturing shifts closer to end users in developed markets. Auto insurer Qualitas Controladora has established a market leading position based on a competitive cost structure in the rapidly growing Mexican market.

Improved corporate governance and tax changes in Japan are facilitating more corporate activity, such as Relia, the IT group acquired at a premium by its affiliate Mitsui in a JPY60 billion takeover.

What does this mean for investors?

Small cap investing may bring elevated volatility, but has shown it can also deliver superior long-term outperformance. There is now an opportunity for long-term investors to enhance potential returns through adding global smaller company diversification. This is currently available at a steep discount to larger companies, ahead of expected interest rate cuts later this year which is expected to narrow this discount.

An actively managed strategy is best placed to identify attractively valued smaller companies that offer exciting long-term risk-adjusted return potential.