UNIT

PRICE (ASX)

NAV

PER UNIT1

PERFORMANCE SINCE INCEPTION2,3

TARGET DISTRIBUTION YIELD4

Access to the world of private equity.

The Pengana Private Equity Trust (ASX: PE1) is a diversified portfolio of global private equity investments, with a select allocation to private credit and opportunistic investments.

The portfolio is managed by one of the largest and longest continually operating allocators to alternative investments in the world, Grosvenor Capital Management L.P.

PE1 seeks to generate, over an investment horizon of at least 10 years, attractive returns and capital growth through a selective and diversified approach to private market investments.

PE1 has traded on the ASX since April 2019.

Some Portfolio Companies

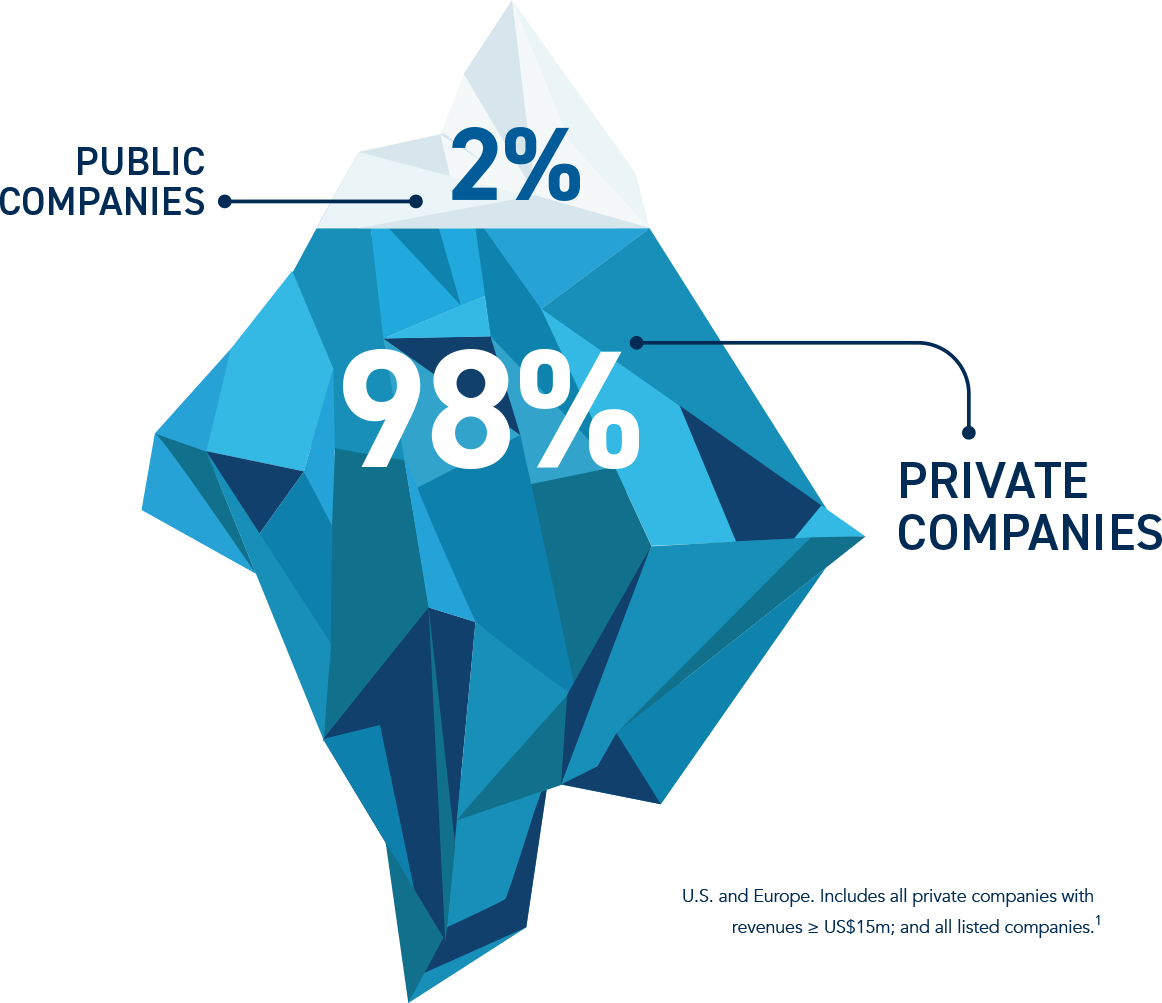

PE1 aims to provide investors with access to the top-performing quartile of global private equity managers, and boasts exposure to over 550 underlying private companies.

Income.

PE1 targets a cash distribution yield equal to 4%p.a.[4]

Access.

The Trust provides investors with a well-diversified portfolio of global private equity investments (including oversubscribed and difficult-to-access middle-market managers) via a single point of entry.

Liquidity.

The structure of the listed Trust has allowed small and large investors to gain exposure to private equity with the flexibility to buy and sell units on the ASX.

You can view a summary of the risks associated with the trust here.

The Pengana Private Equity Trust is Australia’s only listed portfolio of global private market investments, trading on the ASX as PE1. In an effort to help educate investors on this exciting and under-accessed asset class, Pengana’s consulting economist Steven Milch has crafted a comprehensive 4 part white paper series on Listed Private Equity: Private Equity Reimagined.

Private Equity Reimagined. Get all 4 whitepapers direct to your inbox.

THE TEAM

Jason L. Metakis

Managing Director, Co-Head of GCM Grosvenor Private Equity Co-Investments

Read full profile >

Frederick E. Pollock

Managing Director, GCM Grosvenor Chief Investment Officer, Head of Strategic Investments Group and Portfolio Manager of Pengana Private Equity Trust (PE1)

Read full profile >

Brian W. Sullivan

Managing Director, Head of GCM Grosvenor Private Equity Secondaries

Read full profile >

Bradley H. Meyers

Managing Director, Head of GCM Grosvenor Absolute Return Strategies Portfolio Management

Read full profile >

Corey LoPrete

Managing Director, Head of GCM Grosvenor Private Equity Portfolio Management

Read full profile >REPORTS AND RESOURCES

- Monthly Reports

- PDS

- September 2024 - Discover, Snak King & Transact Campus

- August 2024 - Discover, Snak King & Transact Campus

- July 2024 - Recession resilient dentistry

- June 2024 - Financial year in review and outlook

- May 2024 - Education, Packaging, Ferries and Antifreeze

- April 2024 - Filtering for compelling investments

- March 2024 - A busy month

- February 2024 - Medical devices & Industrial transportation

- January 2024 - Healthcare & discounted secondaries

- December 2023 - Investing in stable and defensive businesses

- November 2023 - Investments in insurance and home services as AUD impacts NAV

- October 2023 - Nuts and bolts

- September 2023 - IPO of Instacart

- August 2023 - Co-investing in an insurance brokerage

- July 2023 - Co-investing in banks

- June 2023 - Supporting Higher Education

- May 2023 - A Spotless Investment

- April 2023 - Education, resource efficiency & cleaner energy

- August 2021 - Bolting to new highs

- July 2021 - Investment in Rivian – A first mover in the EV market for SUV's, vans and trucks

- June 2021 - Strong close to an excellent year for PE1

- May 2021 - Filling up the secondaries' bucket

- April 2021 - Coffee Stores in China and Tires in the USA

- March 2021 - Quality secondaries acquired at a significant discount

- February 2021 - Portfolio companies making head way with fundraisings and distributions

- January 2021 - Performance Review & Capital Deployment Update

- December 2020 - Semi-annual Distribution and POINTCLICKCARE

- November 2020 - Investing in great tech companies PRE-IPO

- October 2020 - Waterland, SpaceX & Uber Freight

- September 2020 - MAC II investments start bearing fruit

- August 2020 - AUD continues to rise during August

- July 2020 - How 10 of our largest holdings are performing through COVID

- June 2020 - Performance update

NEWS AND INSIGHTS

Why this US$77 billion investor is investing in more defence when others are chasing growth

Value in the Japanese and European markets is where GCM Grosvenor CIO Fred Pollock is looking for opportunities. Fund Profile...

Hunting for double-digit returns with lower levels of risk

Timestamps 0:00 - Intro 0:16 - Why list on the ASX 1:12 - The philosophy behind PE1 2:04 - Where are the...

- The NAV is unaudited.

- Past performance is not a reliable indicator of future performance, the value of investments can go up and down. The net return has been determined with reference to the increase in the Net Asset Value per Unit, as well as of the reinvestment of a Unit’s distribution back into the Trust pursuant to the Trust’s distribution reinvestment plan (“DRP”). Pengana has established a DRP in respect of distributions made by the Trust. Under the DRP, Unitholders may elect to have all or part of their distribution reinvested in additional Units.

- The NAV per unit at inception is based on the subscription price per unit which is equal to $1.25.

- From 1 July 2020, Pengana intends to target a cash distribution yield equal to 4% p.a. (prorated on a non-compounded basis) of the NAV (excluding the total value of the Alignment Shares but including the cash distribution amount payable) as at the end of the period that a distribution relates to. The targeted distribution is only a target and may not be achieved. Investors should read the Risks summary set out in Section 11 of the IPO PDS.