Poised to deliver.

The short-term impact of stylistic factors in an already attractive sector.

THE CURRENT OPPORTUNITY

Print PDF Version

Investing in global small and mid-cap companies provides great opportunities for high quality active managers to generate differentiated returns and long-term outperformance. This is primarily because the investment universe is not only massive and inefficient, but also significantly under researched. Over the shorter term however, stylistic factors which influence the kind of companies and regions that a manager invests in, can have a significant impact on returns.

Over the last few years, larger, growthier, US based businesses have outperformed the broader market, and managers with styles favouring those characteristics have accordingly enjoyed a strong run. For reasons set out below, we expect that we are now entering a more favourable investment environment for companies in different regions, and with different characteristics, than those that have previously enjoyed investment tailwinds.

The geographically diversified Pengana Global Small Companies portfolio holds approximately 50 companies, all targeting the following key criteria:

- Sustainable business models with pricing power and enduring competitive advantages

- Strong balance sheets with an ability to fund operations during periods of capital market disruption

- Disciplined and aligned management with strong corporate governance and a focus on compounding invested capital

- A compelling valuation providing downside protection

The application of these criteria positions the portfolio to benefit from two of the major investment themes that we see starting to emerge.

1. Inflation

History tells us that two investment characteristics tend to perform better during inflationary periods, value and small-caps.

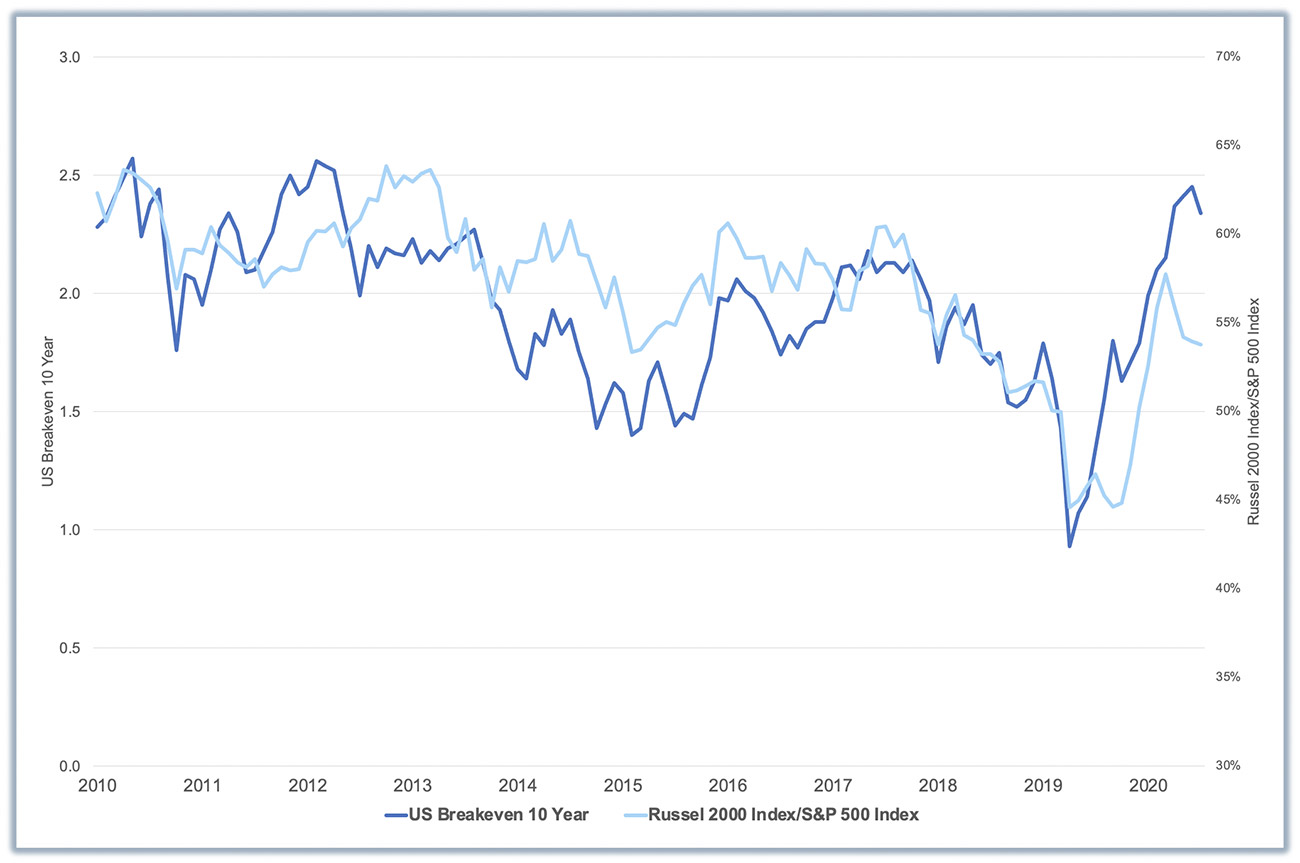

Since 2010 small cap-stocks have outperformed large caps during periods of rising inflation expectations, figure 1 below shows the relative outperformance of small-cap stocks coincided with a sharp rise in inflation expectations, as measured by the difference in yields on nominal U.S. Treasury 10Y Notes and 10Y Treasury Inflation Protected Securities (TIPS), from a March low of below 1% to a recent high of almost 2.5%

Figure 1 Source: Bloomberg

After many years of sluggish price growth, a number of factors have contributed to the emergence of inflation expectations.

- government stimulus,

- supply chain bottlenecks,

- elevated levels of household savings during lockdowns which give consumers additional purchasing power, as well as,

- global wage increases.

Prices paid by US consumers surged in June by the most since 2008 with core inflation (excluding food and energy) having the largest advance since 1991. In Britain, June inflation exceeded targets (and expectations), and the European Central Bank just revised their inflation target that has been in place since inception, from below 2% to 2% with a footnote that it will tolerate overshooting to make up for previous shortfalls.

2. Valuation differentials and the European recovery

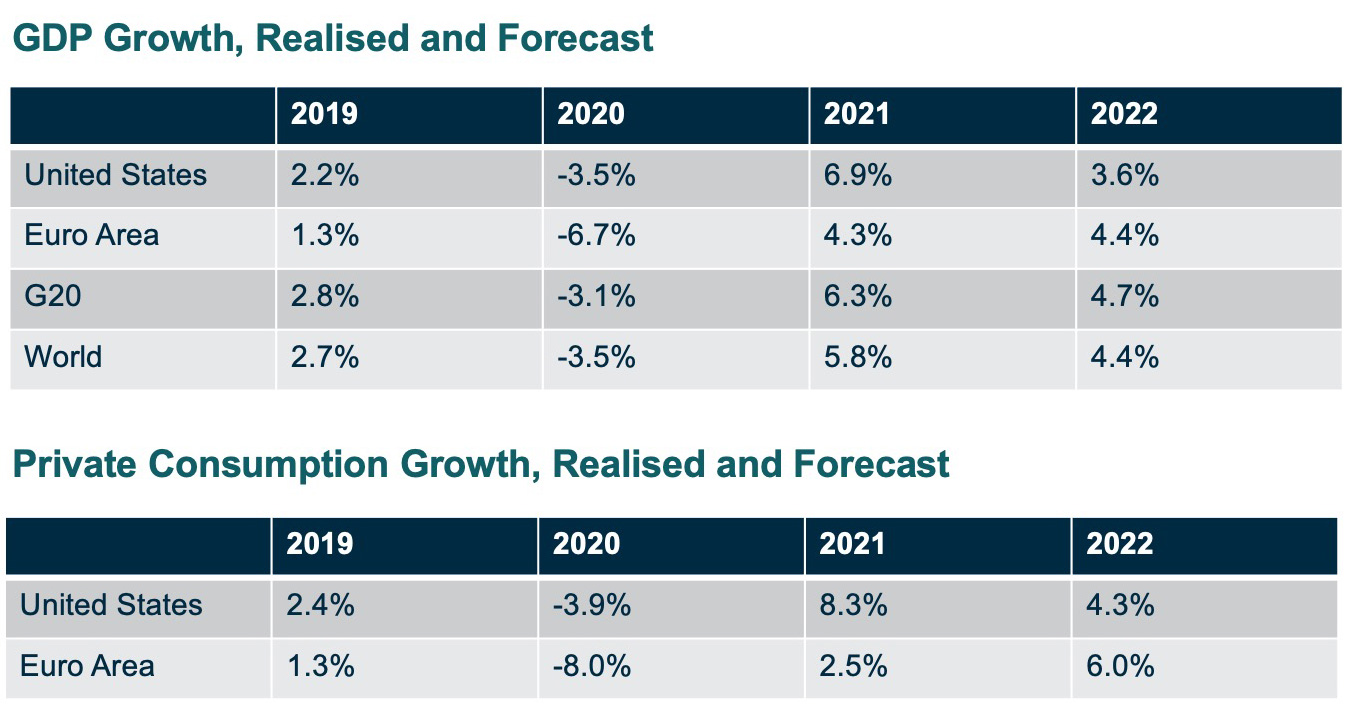

European industrial companies, on average, did not enter the COVID-19 disruption at full capacity. 2019 GDP growth in the Euro Area was a paltry 1.3% percent and many businesses had reduced inventory in response to falling demand. Inventories then declined even further as supply chains were disrupted during the pandemic. It is now likely that the release of pent-up demand as vaccinations rates increase and societies emerge from lockdown, combined with monetary stimulus and other support measures, will create the ideal conditions for an industrial-led recovery. This is further supported by the OECD forecast of a significant rebound in private consumption through 2022. (see figure 2)

Figure 2 Source OECD Economic Outlook, Volume 2021 Issue 1 31 May 2021.

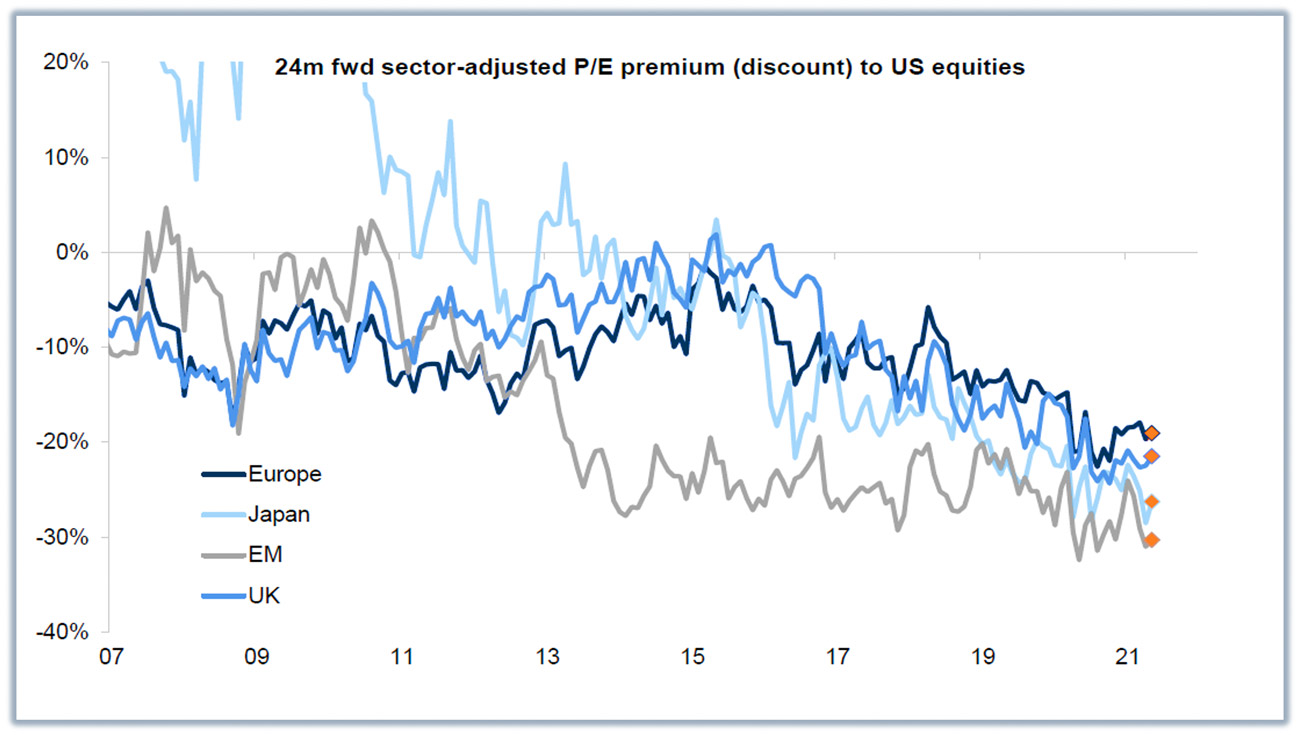

Regardless of investment style, valuations should always be considered. A sector–adjusted PE comparison removes the inevitable distortions which result from the dominance of different businesses in different regions. The valuation premium currently associated with US Equities is near its highest level since the GFC (See Figure 3).

This may make sense in the context of the GDP growth differentials experienced over the last few years, but Equities are forward-looking, and the valuation differential is harder to accept in the context of the forecasts.

Figure 3 Source – May 2021, Source FactSet, Goldman Sachs Global Investment Research

The Pengana Global Small Companies Opportunity – Poised to Deliver

The Pengana Global Small Companies Fund invests in high-quality businesses with strong pricing power (the ability to pass on the increases in input costs) and favourable operating margins.

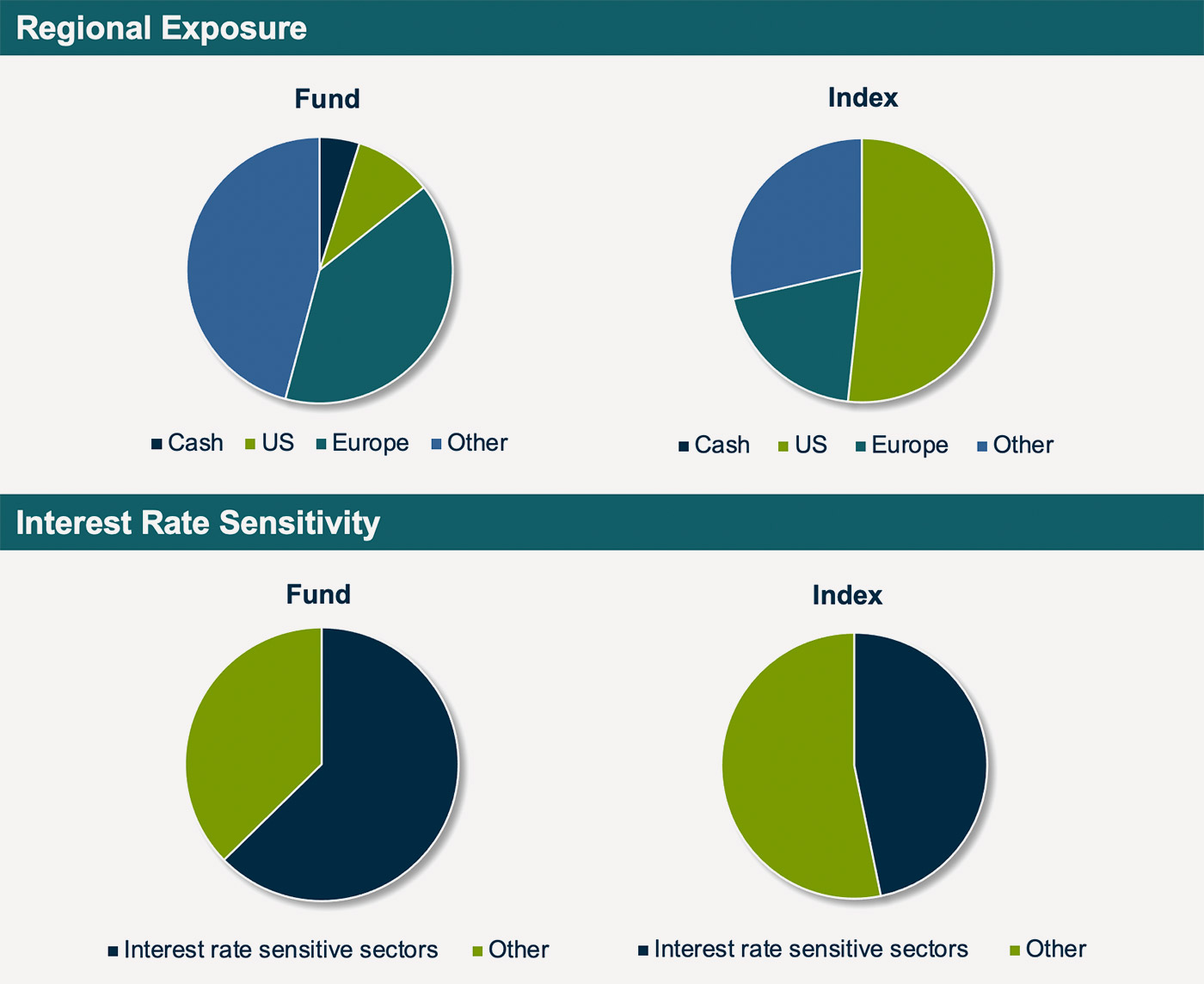

It is also disproportionately invested in sectors that will benefit from an increase in interest rates, (see Figure 4), as well as more reasonably valued jurisdictions resulting in a significant overweight to Europe.

It is also overweight industrial businesses, and those sectors that will benefit most from a consumer-led recovery. Investments in businesses like Dino Polska, the Polish Grocery chain which has been held in the portfolio since July 2017 is well poised to take advantage of the evolving economic environment; or the 100-year-old ferry service between the UK and Ireland, the Irish Continental Group, which was more recently purchased to capture the increase in activity as these two economies emerge from lockdown.

Figure 4

It is not unusual to experience increased volatility with the potential for drawdowns as we rotate through a difficult period of the investment cycle. We have several stocks on our watch list and would use any short-term price disruptions to enhance our positioning.

To date the Fund has kept pace with the index due to solid stock picking by the team across all markets, even though as a valuation-focused manager, it did not benefit from the stylistic tail winds of the last few years, particularly since the valuation discipline led to a significant underweight in the US, and a larger allocation to Europe and the rest of the world.

If for the reasons described above, investments in high-quality reasonably priced companies with economic tailwinds are rewarded, our investors are likely to reap these rewards.

For more information on the Pengana Global Small Companies Fund some more resources are available below:

Important Information

Pengana Capital Limited (ABN 30 103 800 568, Australian Financial Services Licence (“AFSL”) No. 226566) (“Pengana”) is the issuer of units in the Pengana Global Small Companies Fund (ARSN 604 292 677) (“the Fund”). The Product Disclosure Statement for the Fund (“PDS”) is available and can be obtained from www.pengana.com or by contacting Pengana on (02) 8524 9900.

This information has been prepared without taking account of any person’s objectives, financial situation or needs. Therefore, before anyone acts on this information they should consider the appropriateness of this information, having regards to their objectives, financial situation and needs. A potential investor should obtain the PDS and consider the PDS carefully before making any decision about whether to invest in, or to continue to hold, units in the Fund.

None of Pengana, Lizard Investors LLC (“Lizard”), nor any of their related entities, directors, partners or officers guarantees the performance of, or the repayment of capital, or income invested in the Fund. An investment in the Fund is subject to investment risk including a possible delay in repayment and loss of income and principal invested. Past performance is not a reliable indicator of future performance, the value of investments can go up and down.

Pengana has appointed Lizard as Pengana’s corporate authorised representative under Pengana’s AFSL.

While care has been taken in the preparation of this information, neither Pengana nor Lizard make any representation or warranty as to the accuracy, currency or completeness of any statement, data or value. To the maximum extent permitted by law, Pengana and Lizard expressly disclaim any liability which may arise out of the provision to, or use by, any person of this information.