The Case for Diversification: What Manager Dispersion Tells Us About Private Equity Returns

Are investors missing more of the growth story than ever before? Over the past two decades, the global equity landscape has quietly transformed. Many of today’s most innovative and disruptive companies are staying private for far longer, meaning public market investors are increasingly missing out on the most dynamic phase of corporate growth.

In the 1990s, the average US company went public after around four years. Today, that number exceeds twelve1. This reflects more abundant private capital, deeper institutional investor appetite, and the rise of specialist private equity and venture platforms that can support large-scale expansion without the scrutiny of quarterly reporting. The result is that many of the world’s leading businesses are now maturing in private markets before ever reaching public investors.

The changing face of corporate growth

The recent surge of innovation across artificial intelligence, fintech, and advanced manufacturing has accelerated this divide. Companies such as OpenAI and SpaceX have reached valuations in the hundreds of billions of dollars while remaining private. Their growth has been driven by mission-critical technology, long investment horizons, and access to deep, patient capital.

By contrast, listed markets are increasingly dominated by mature incumbents and capital-light digital platforms. These remain important allocations, but they capture a narrower slice of the global growth engine. The real economy, where businesses are being built, scaled, and monetised, now extends well beyond public benchmarks.

When public meets private

Morningstar recently launched a “Public + Private” index in the United States which highlights what institutional investors have known for years, that corporate leadership increasingly emerges in private hands long before public investors can participate. For investors building diversified portfolios, this shift has important implications. Listed index benchmark exposure alone no longer guarantees access to the world’s growth engines.

Why companies are staying private

Several forces are driving this shift. Growing regulatory and disclosure demands have made public markets less appealing, especially for founder-led or technology companies that value the flexibility to pursue growth without quarterly reporting pressure or constant market reaction.

At the same time, private funding has broadened and matured. Companies now have access to patient capital, hands-on operational support, and global networks that help them scale more efficiently. This environment enables management teams to follow long-term funding pathways tied to meaningful milestones rather than short-term earnings cycles, providing support through their most important growth stages.

For investors, the challenge is access. While institutional portfolios have long allocated to private equity, most retail portfolios have lacked the same reach.

Manager skill and diversification matter most in private markets

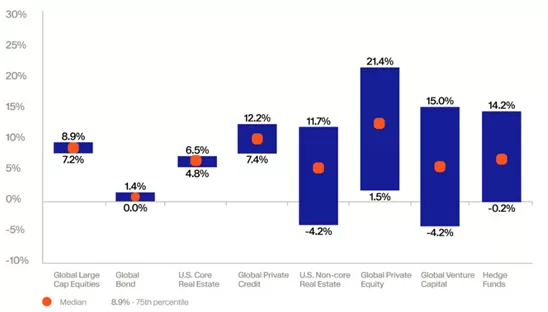

Private equity isn’t only about accessing high growth companies; it’s about harnessing skilled management and thoughtful portfolio construction to deliver more consistent outcomes. Unlike public markets, where manager performance tends to cluster tightly around the median, private markets show much greater dispersion in returns.

The performance gap between PE managers is wide and persistent2

Global Private equity Internal Rate of Return (IRR) dispersion by vintage year, 2000-2020

The dispersion chart above highlights this contrast. Private equity returns vary significantly between the best and worst performing managers, underscoring how skill and access influence outcomes. This difference reinforces why diversification across strategies, sectors, managers, and vintages is so important. Vintages simply reflect the year capital is invested. Investors relying on a single manager or narrow exposure face a far greater risk of underperformance.

Bridging the access gap

Australian investors are not without options. The Pengana Private Equity Trust (ASX: PE1), launched in 2019, was designed to provide listed access to a diversified portfolio of global private equity investments managed by GCM Grosvenor, a US-based private markets firm with over 50 years of experience managing institutional capital.

The portfolio includes exposure to leading private companies such as SpaceX and OpenAI, alongside hundreds of other resilient businesses across multiple vintages, sectors, and geographies. Importantly, the portfolio has also generated liquidity from high quality holdings, such as BlueTriton Brands, a leading North American bottled water company, and Kroll Bond Rating Agency, an independent provider of credit ratings and risk analysis. These events highlight both the depth of the opportunity set and the valuation discipline applied across the portfolio.

Like the concept behind Morningstar’s new index, PE1 connects investors to the world’s private growth engines through a listed structure. It offers exposure to businesses driving innovation and value creation long before they reach public markets, while still providing the liquidity and transparency of an ASX-listed vehicle.

The bigger picture

As investors rethink diversification, the traditional boundary between public and private markets is becoming less useful. What matters is access to where real economic growth is happening. The companies driving the next decade of innovation are often still privately held, and that reality requires portfolio construction to evolve.

Allocating to private markets is no longer an emerging trend. It is becoming a defining feature of modern portfolio design.

Download PDF Version HERE.

- Jay R. Ritter, “Initial Public Offerings: Updated Statistics,” Warrington College of Business, University of Florida, April 7, 2025, Table 4, https://site.warrington.ufl.edu/ritter/files/IPO-Statistics.pdf.

- Morningstar, Burgiss, NCREIF, PitchBook, LCD, PivotalPath, J.P. Morgan Asset Management, as cited in Moonfare, “Is Private Equity Still Outperforming Public Markets?” August 2025, https://www.moonfare.com/blog/private-equity-returns-2025

William Dougall, Investment Specialist