How Microsoft Became the Business World’s Portal to Generative AI

After missing out on the smartphone era, the company made its software indispensable to the workplace. Now, as businesses look to the new era of artificial intelligence, the Microsoft 365 and Microsoft Azure platforms may be a chosen gateway.

Key Takeaways

- Microsoft’s investments in workplace-productivity software and cloud computing have enhanced its bargaining power over buyers—and the likelihood that they’ll turn to the company for their AI-related needs.

- New technology is bound to draw new market entrants, but the significant financial resources and vast amounts of data needed to be successful in AI may give a leg up to industry incumbents such as Microsoft.

- By primarily focusing on business applications, Microsoft may be somewhat shielded from the social dilemmas and reputational hazards introduced by AI that have posed a challenge for companies such as Alphabet and OpenAI.

Every worker that spends their day in front of a Windows computer almost always has an iPhone or Android-powered smartphone within reach. It’s a constant reminder of Microsoft’s failure almost two decades ago to turn its unmatched strength in desktop operating systems into a leadership position in mobile operating systems. Bill Gates has said ceding that ground to Apple and Alphabet in the mobile market was his biggest mistake, but that the Microsoft of those days was distracted and unprepared for the smartphone revolution.

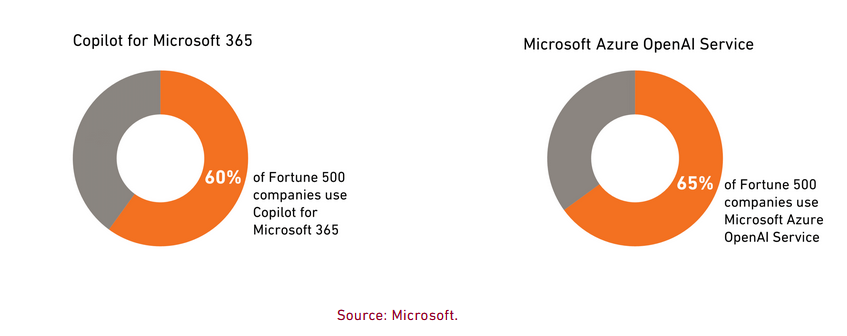

Not this time. As generative artificial intelligence (AI) is poised to potentially transform the economy, and business applications rather than consumer gadgetry move to the forefront, Microsoft’s sharp focus on its workplace-productivity software and cloud-computing platform have positioned it in the sweet spot of early AI demand. While it’s too soon to know which companies will be the biggest long-term winners from AI, Microsoft has an edge because many businesses’ workflows are already inextricably intertwined with its software. That has helped Copilot, the AI-powered chatbot that Microsoft began integrating into its products in late 2023, quickly amass a user base that includes nearly 60% of Fortune 500 companies.

Microsoft’s competitive advantage in enterprise software is largely the result of a strategic reset 10 years ago, when Satya Nadella took over as chief executive and reoriented the company around its business customers and their software needs. It was a strategy implemented through a number of incremental decisions over many years, but in 2017, two product decisions, unrelated to each other, would symbolize the shift: Microsoft stopped putting development resources behind the failed Windows Phone and started making its new Teams collaboration software available to Microsoft Office subscribers globally.

As Microsoft’s emphasis continued to shift from on-premises software and consumer-facing products—Windows, Bing, Xbox (parts of a division that remains profitable)—toward the much larger profit opportunity of building a business-software ecosystem delivered over the cloud, the conditions were created that would later put Microsoft in a favorable position for the AI era. These conditions include its strong bargaining power over buyers, sprawling data-center business, financial strength, and customer trust.

Bargaining Power

Whether a company thrives largely depends on the competitive structure of its industry, which is shaped by factors such as the bargaining power of buyers. An important source of bargaining power in Microsoft’s industry is the high switching costs, or the burden customers experience when changing suppliers. Once a company’s workforce is accustomed to the functionality, common language, file formats, and workflow of certain software, switching providers can be highly disruptive to operations.“If a company decided it was no longer going to use the Microsoft suite, it would be incredibly annoying for everyone there,” as well as perhaps clients and partners with which it shares files and other digital assets, said Chris Mack, CFA, an analyst and portfolio manager for Harding Loevner. “If a rival product is only slightly better, or switching only saves you a few cents, it’s probably not worth the effort.”

An important source of bargaining power in Microsoft’s industry is the high switching costs, or the burden customers experience when changing suppliers.

Microsoft Teams has come to play an important role in switching-cost considerations and the company’s pricing power, especially as businesses embrace hybrid and remote work. The app, which competes with services such as Slack, a division of Salesforce, provides a central place for users throughout an organization to collaborate on projects and streamline workflows that often stretch across various other Microsoft products—including traditional Office software such as Word, Excel, and PowerPoint, as well as newer tools, such as Viva Insights, for tracking employee productivity, and the Power Platform, for creating customized business apps without heavy coding. Teams can also connect to non-Microsoft products such as Salesforce’s popular customer relationship management software. Microsoft last reported in October 2023 that Teams had 320 million monthly active users. For perspective, TikTok, the popular social-video app, had more than 1 billion monthly active users globally and 170 million in the US.While the economic rewards that Microsoft gets, in part, because of its bargaining power can support its AI expansion, the reverse is also true: AI can enhance the perceived value of apps such as Teams. For example, the company said in January that more than two-thirds of Teams enterprise customers pay to add Teams Rooms for virtual meetings, Teams Phone for direct calls, or Teams Premium, which uses AI to take notes and create follow-up tasks from calls and meetings. Microsoft’s Copilot chatbot can also help users work more efficiently in various apps by responding to natural-language prompts for assistance—bypassing some of the quirkier elements of Microsoft’s legacy software that sometimes led users down a rabbit hole of internet searches to try and figure out how to do what they were trying to do.Over the trailing 12 months, Microsoft’s productivity and business-processes division earned US$39 billion, for an operating margin of 52%, up from US$15 billion and an operating margin of 39% in the 12 months ended March 31, 2019. This durable profitability is why losing out on smartphones did not damage Microsoft in the long run. In fact, it’s the second-most valuable company in the world today.

Cloud Friend and Foe

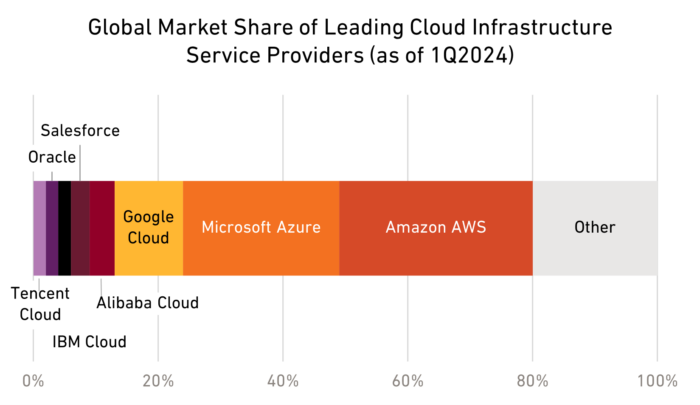

As Apple’s smartphone empire grew, and other tech giants built large social media and search businesses, the profitability of Windows and the Office suite also enabled Microsoft to invest in the cloud, an area of strategic importance for AI. Cloud computing refers to renting data storage, computing power, and networking capabilities from off-site hosting systems that deliver these services over the internet. Although Microsoft was once considered a significant laggard in this area, its Azure cloud-computing platform has become Nadella’s crowning achievement. Microsoft now has one of the broadest global data-center footprints—so large that the company is the biggest purchaser of carbon-capture credits to offset the energy demands of operating and cooling its more than four million servers. In the first quarter of 2024, Azure had a 25% share of the cloud-infrastructure market, edging closer to the 31% share held by Amazon.com’s AWS, the market leader.

Source: Statista.

Data as of March 31, 2024.

Microsoft’s strategy for both Azure and Microsoft 365—the broader productivity-software suite that includes the collection of apps formerly known as Office— has been to position itself as a partner to not just its customers, but also its rivals. As it gathers data on customer usage to quickly resolve pain points and add new features, customers come to trust that Microsoft will keep them up to speed on tech innovation, minimizing the temptation to try an alternative software vendor. But because Azure also has an open architecture, a customer using Red Hat’s Linux operating system, for example, can run it on Microsoft’s data centers, even though Linux is a competitor to the Windows business.

“Red Hat wasn’t going to build data centers, so it said, ‘OK, we’ll bring our solutions to Microsoft’s platform,’” Mack said. “There’s a saying: When in doubt, go with Microsoft.”

Partnering with a would-be rival is also what put Microsoft on the map when it comes to AI. The launch of ChatGPT in November 2022 showed the world that a technology long considered to be the stuff of sci-fi fantasies had quietly advanced, and that it was ready to be used in the real world to perform daily work functions. It also lit a fire under Big Tech companies. Microsoft, which had already invested in OpenAI, the company behind ChatGPT, increased its stake and created a formal strategic partnership. Azure now powers OpenAI’s workload—the array of computing tasks needed to run its applications—as the exclusive cloud partner for the company. Microsoft has also integrated OpenAI’s AI models into its Azure AI service platform, giving Microsoft’s users a way to securely train custom AI models using their own proprietary data.

New Challengers and Challenges

Whenever an industry faces a disruptive change, the threat of new entrants is high. For the incumbent market leaders, there is a risk of complacency. But to be successful in AI, a company needs plentiful data to train an AI model and significant financial resources—programmers, data storage, and the GPU accelerator chips that power AI models cost lots of money. These conditions leave incumbents such as Microsoft in an enviable position.Financial strength is important in other ways. While large tech companies reaped the benefits of a decade of low-cost capital and tremendous cash flows, the picture looks different for startups: The post-pandemic venture-capital market has been hit hard by rising interest rates and other setbacks, which have dried up funding. Customers don’t want to have to worry that the success of their software vendor’s next funding round might affect their AI capabilities.The potential risks from AI have led businesses to be cautious, which makes trust paramount. A new technological age will inevitably bring challenges—some have already made headlines. When this happens, customers are more likely to give the benefit of the doubt to larger, well-established software providers with which they’ve had long-term relationships.

Customers don’t want to have to worry that the success of their software vendor’s next funding round might affect their AI capabilities.

Focusing on the business uses of generative AI may also provide Microsoft more distance from the social dilemmas being introduced by the technology. For example, when AI models scrape the internet for their training data, they run the risk of perpetuating harmful stereotypes and inaccuracies. In trying to avoid this problem, Alphabet’s Gemini model overcorrected for bias, and generated images that showed white historical figures, such as the US Founding Fathers, as people of color, leading to a string of unflattering news stories. In business settings, the prompts given to an AI model may be less likely to lead it into controversial territory although the stakes are higher and the tendency of AI models to “hallucinate” errors remains a risk.OpenAI also recently found itself in a dispute with the actress Scarlett Johannson—who played an AI chatbot in the 2013 film Her—for using a voice much like Johannson’s for its AI personal assistant. Microsoft’s Nadella, on the other hand, is trying to keep the company out of such ethical debates by saying that AI should be thought of as a tool, not a human. “I don’t like anthropomorphizing AI,” he said in a May television interview.It’s also in Microsoft’s interest to present AI as just another feature of its software ecosystem, and not something separate that poses a threat. For example, a worker can Teams message a colleague to discuss an Excel graph for a PowerPoint presentation that they built with Copilot. That framing reinforces the notion that Microsoft has become the language of business processes and that, for now, AI are just two letters helpfully added to its alphabet.But the evolving debates over how to refer to AI—and for those in the Nadella camp, how to use “it”—are a reminder that the race has only just begun. It may be years before all the applications for AI come into full view and reveal which revenue models will be successful. However, Microsoft, by becoming the default workplace software system over the past decade, has an enviable head start.

Contributors

Christopher Mack, CFA, analyst and portfolio manager, contributed research and viewpoints to this piece.