Quality Compounding in a Hot-Stock World

While the market chases speculative trends and momentary winners, high-quality companies are building value quietly and letting time do the work.

Patient ownership of the shares of high-quality businesses is an investment approach that, on the surface, has had a tough time lately.

Markets seem to have rewarded speculative trends, not fundamentals (the evidence of whether a trend is benefiting a business). Aggressive assumptions about future spending on artificial intelligence, weight-loss treatments, and national defense, for example, have produced outsized market winners in recent quarters and years.

However, when overly optimistic forecasts are used to justify stretched valuations, the same stocks that are hot one day can take a cold plunge the next. By contrast, history shows that investing for the long term in quality compounders—businesses with durable competitive advantages, the prospect of sustainable growth, and strong free cash flow—is a more reliable path to wealth than chasing hot stocks. Why, then, are so many investors lured into the chase?

Behavioral biases play a key role.

Mind The (Behavioral) Gap

Human behavior is a strong force in investing, and it can lead to flawed thinking. For example, rising share prices can make people overconfident, leading them to buy regardless of valuations or business results (just as falling prices can spark unsubstantiated fear and panicked selling). Studies show that such reflexive behavior is costly. Morningstar’s annual “Mind the Gap” report illustrates this by comparing the returns of a buy-and-hold strategy with those of an average investor who tries to time their trades. For the 10 years through December 2024, it found that the average investor earned 7.0% annually, while the underlying investments would have returned 8.2% annually if left uninterrupted. That gap compounds into roughly 15% less wealth over a decade, all because of poor timing.

Chasing hot stocks inevitably leads to more trading activity. Yet one of the most famous studies on investor behavior found that the more people trade, the worse they do. Researchers Brad Barber and Terrance Odean analyzed more than 66,000 brokerage accounts from 1991 through 1996 and found that the most active traders earned only 11.4% annually compared with a market return of 17.9%. Their landmark paper, “Trading Is Hazardous to Your Wealth: The Common Stock Investment Performance of Individual Investors,” attributed much of the performance gap to excessive turnover and transaction costs.

To be sure, a company can have a hot stock and be a high-quality business—the two are not mutually exclusive. The problem arises when markets mistake the popularity of a company’s shares for the strength of its business.

Why Patience Prevails

When Jeremy Siegel and Jeremy Schwartz tracked the original members of the S&P 500 Index over several decades from 1957 to 2003, they found that simply holding those stocks would have significantly outperformed the continually updated index. The originals beat their replacements in nine out of 10 sectors, often with lower volatility and greater downside protection. And a more recent study emphasized the traits that underpin a company’s durability: shares of companies that consistently reinvested and maintained profitable growth across economic cycles delivered excess risk-adjusted returns of more than five percentage points annually and were more resilient in the long run.

Investing in quality compounders works for two main reasons. High-quality companies tend to have steady growth rates, and time allows the effects of that growth to accumulate. These businesses can reinvest earnings at high rates of return, creating a self-reinforcing cycle: profits generate additional profits through reinvestment and scale, cash flow supports further expansion, and company value steadily increases. For example, a company whose earnings grow 10% annually doubles its profit in roughly seven years.

Still, share prices don’t march in step with profit growth. Even when business performance is stable, shifts in sentiment or market conditions can compress valuation multiples, making a sound investment temporarily seem like a loser. Therefore, it is essential to distinguish between erratic share-price movements and earnings deterioration. Even the best businesses encounter bumps, but over time, consistent earnings growth compounds, offsetting the pain of short-term market dislocations.

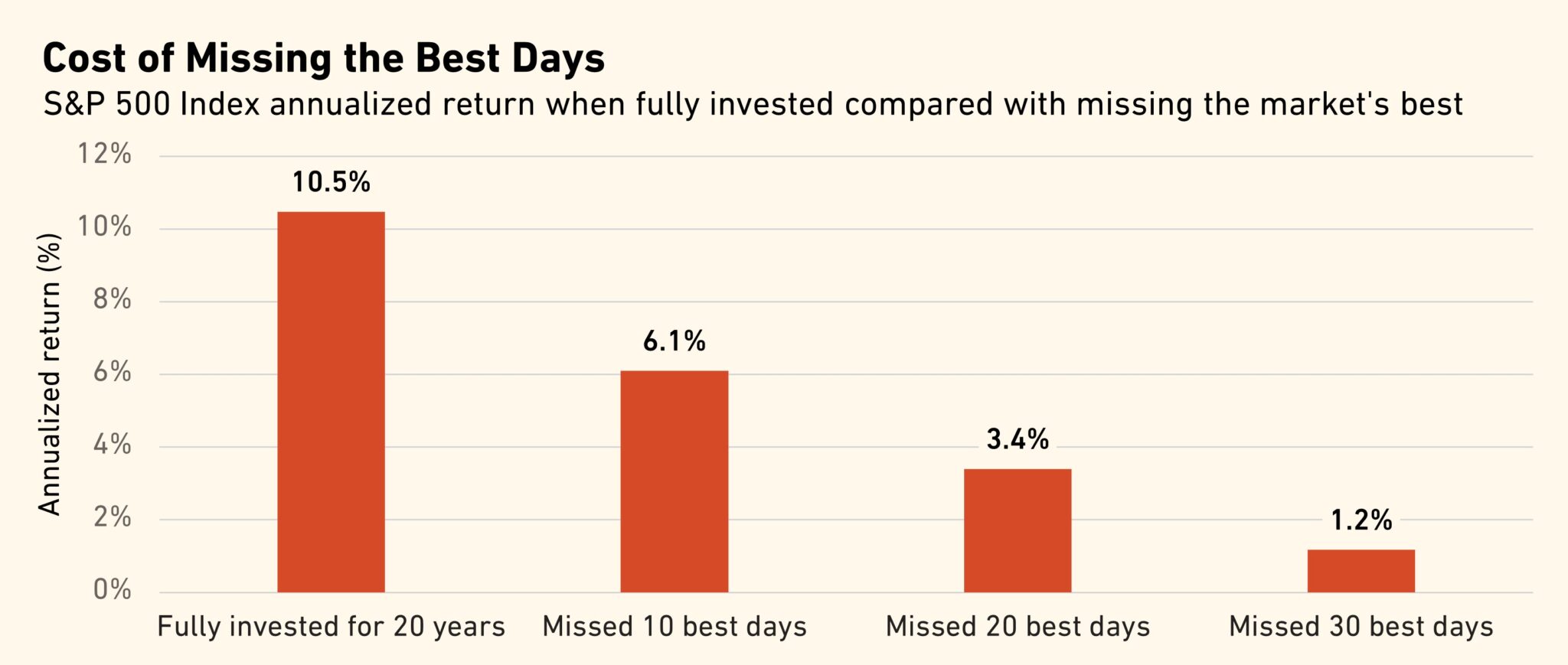

Although the wait can be uncomfortable, recent studies confirm that market gains come in unpredictable bursts, and stepping aside at the wrong moment interrupts the power of compounding, which can devastate returns. For example, JPMorgan Chase found that over the past two decades, seven of the 10 best trading days occurred within two weeks of the 10 worst days. Missing those ten best sessions slashed annualized returns roughly in half. In US dollar terms, that means a $100,000 investment would have grown to about $734,000 over the 20-year period if fully invested, but only $327,000 if you missed the market’s ten best days. The gap widens even further if more than ten of those strong days are missed.

Source: Factset. Data as of October 31, 2025.

Markets will always crown new favorites—and potentially discard them once sentiment shifts. The temptation to chase those swings is powerful, but it rarely ends well. All the while, quality businesses quietly build value. As their profits grow, reinvestment compounds, and time handles the rest. Therefore, the greater risk isn’t share-price volatility. It’s the temptation to abandon sound businesses when prices diverge from long-term fundamentals.

Compounding may not feel like a winning strategy every quarter or from year to year, but it wins where it counts: across the decades.

Written by Harding Loevner. Portfolio Specialist Apurva Schwartz contributed research and viewpoints to this piece. Read the original article here.