March madness – what does the banking turmoil mean for sustainable investors?

What happened?

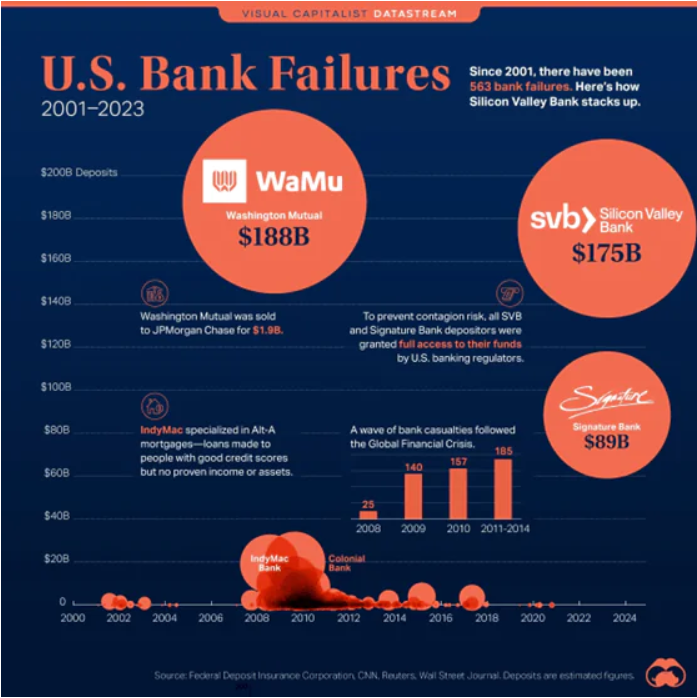

On 10th March Silicon Valley Bank (SVB), the 16th largest lender in the US, collapsed. Two days earlier the bank had realised a US$1.8 billion loss selling investments to meet withdrawals. The announcement of a capital raise prompted further withdrawals with panic spreading amongst its venture-capital customers.

Regulators took control of the bank and two days later the Federal Reserve, the Treasury Department, and the Financial Deposit Insurance Corporation unveiled emergency measures to stem the fallout. Importantly, customers were assured they would get their money back.

Second largest bank failure since 2001

Source: Visual Capitalist

A little over a week later in Europe, Credit Suisse’s 167-year history came to an end. The bank had seen outflows of around US$10 billion a day that week. The chairman of Saudi National Bank then triggered a fire sale when he stated on Bloomberg TV that they would not offer additional financial support.

The Swiss National Bank eventually brokered a US$3.2bn takeover by UBS. Shareholders received CHF0.76 per share, about 75% less than they were worth at the start of the month. Low-ranking bonds worth US$17bn were wiped out.

Does it affect the Pengana WHEB Sustainable Impact Fund?

There were ripple effects throughout the banking sector, particularly for regional lenders in the US and in Europe most notably for Deutsche Bank which has been seen as another problem child in the industry.

Contagion in the banking sector

Source: Factset data

Source: Factset data

The Pengana WHEB Sustainable Impact Fund invests in impactful companies which produce goods and services that solve sustainability challenges. Our fund has no direct holdings in banks. The publicly listed banks which are large enough for us to own aren’t typically targeting areas of the market with high unmet need, and as such we don’t view them as solving a sustainability challenge.

However, there are indirect effects that are important for us to consider. First is the potential knock-on effect on innovation. Second is the broader implication for market sentiment and central bank policy direction.

Innovation: focus on climate and biotechnology

SVB was a prominent lender to start-ups and it counted over 1,500 companies involved in climate technology as its customers.¹ In the solar industry, SunRun, one of the largest residential installers in the US publicly disclosed exposure to SVB through its credit facilities. The total represented a small proportion of its overall credit but the stock still fell 12% as a result.

What the SunRun exposure hints at is the wider risk to growth in climate technology. The Inflation Reduction Act is in part targeted at bringing clean energy to low-income communities. This market is typically served by local and regional banks.2 While SunRun is likely large enough to remain viable, smaller developers may face financing challenges. It is possible that larger companies will be able to benefit in the short-term by picking up market share. However, if difficulty accessing capital means start-ups are struggling to invest or are simply failing, there is a risk the innovation which is crucial to meeting longer-term climate goals, will be stifled.

Our holdings in the solar industry include Enphase, SolarEdge, and First Solar. None of these companies have significant exposure to SVB. They are impacted by industry growth, and share prices have been volatile as a result of uncertainty in the market. However, First Solar, as an example, has sold out of capacity until 2026. We believe it is highly unlikely the fallout from the banking issues will persist beyond then.

Similar issues face biotech start-ups. About half of all US biotech companies banked with SVB and its collapse will likely make access to funding harder.³ As with climate technology the real concern is the long-term chilling effect on innovation. This has no immediate impact on our holdings, but companies involved in clinical trials and contract manufacturing, such as ICON and Lonza, could be affected if the overall pipeline starts to slow. From an impact perspective this could delay potentially life-saving innovations coming to market.

Contagion effect

There have been more immediate implications. Amid the initial chaos, equity markets had their worst week of performance since January and have continued to be volatile since. The main focus has been on the banking sector and what these events could mean for regulation. Sectors such as clean energy and biotechnology have also been volatile as a result of the knock-on effects described above.

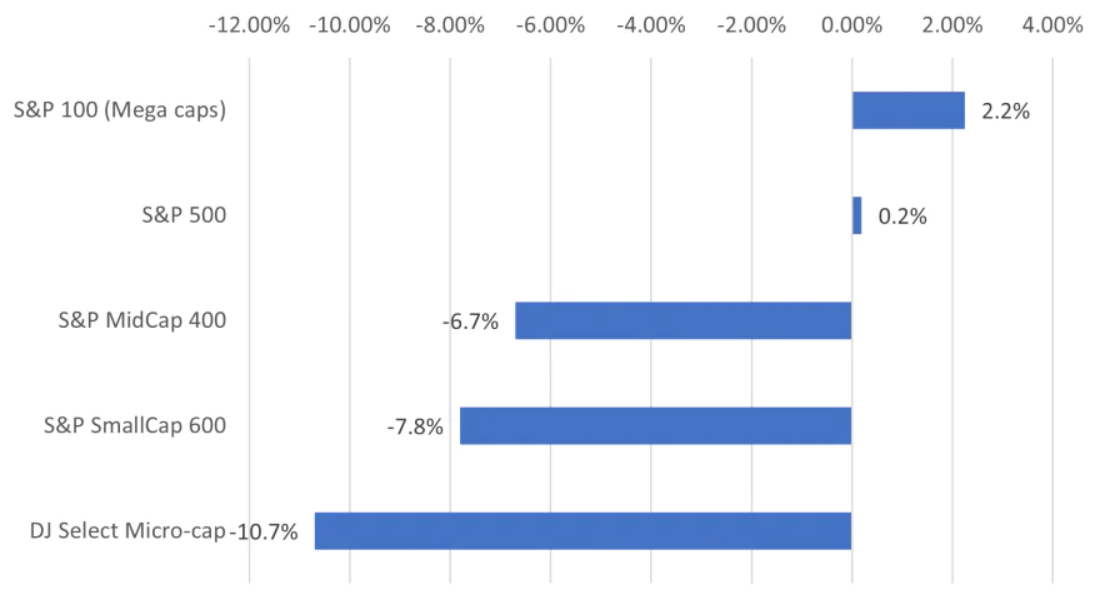

What’s more surprising perhaps is that markets haven’t been weaker. The S&P 500 was broadly flat over the month. However this masks underlying dispersion as small- and mid-caps significantly underperformed large-caps, and in particular the large technology stocks which have been seen as a safe haven.

Index Performance by market cap March 2023

What does it all mean?

It is unlikely we will know the extent of the impact of the banking turmoil for some time. The path of economic growth is uncertain as is the lending environment. Longer-term there are question marks about financial regulation and risks to innovation in key areas of the economy relating to sustainability goals.

At WHEB, our focus on quality means we typically avoid companies with significant borrowing and we have no investments in banks. That has meant there are no immediate concerns about direct effects on the portfolio. In the short-term the portfolio is affected by the negative sentiment toward mid-caps and the general volatility in markets. We will also have to monitor the situation in US climate and biotech funding as that could have indirect consequences for our holdings. However, we remain confident that the strong market positions and differentiated products continue to support the long-term view for these businesses.

1 https://www.nytimes.com/2023/03/12/climate/silicon-valley-bank-climate.html

2 https://www.ft.com/content/5cd9822e-6695-4a07-b261-bad90d8e0bde?shareType=nongift

3 https://www.reuters.com/business/finance/svb-fall-casts-shadow-early-stage-us-biotech-2023-03-13/

4 https://www.ft.com/content/92c46ac5-6e67-4620-8798-b95a5a2fba72