Pengana to acquire stake in Chicago-based Lizard investors

Pengana Capital Group Limited (ASX: PCG, ‘Pengana’) today announced its intention to acquire a significant stake in Lizard Investors LLC (‘Lizard’), a Chicago-based asset management firm that specialises in global small to mid-cap equities.

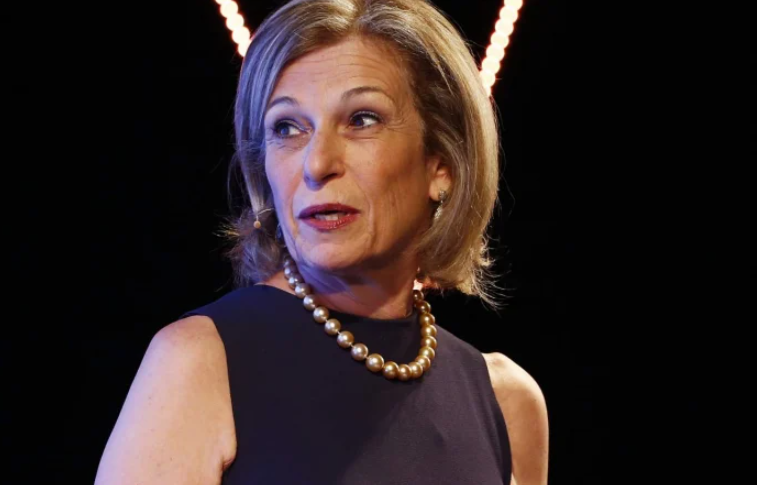

Lizard founder and Chairman, Leah Zell, is considered to be one of the foremost global small cap fund managers in the US and a pioneer in global small cap investing. Building on an association forged two decades ago between Leah and Pengana’s founder, Russel Pillemer, Pengana in 2015 entered into a joint venture with Lizard to sub-advise the Pengana Global Small Companies Fund, bringing Lizard’s extensive funds management expertise to Australian investors.

This proposed acquisition extends what has been a successful partnership to date, presenting an opportunity for Pengana to take an ownership stake in a synergistic premium funds management business which has growth opportunities and a sophisticated investor base.

Russel Pillemer said “This is a great opportunity for Pengana to expand into the US market not only via the growth of Lizard’s global small cap capabilities but also by utilising Lizard as a platform to launch additional offerings, similar to what Pengana has done in the Australian market. Expanding our business into the US alongside Leah Zell and CIO Jon Moog is a major advantage as they are ideal partners for us in that market. Our growth plans are based on the organisational and cultural alignment between Pengana and Lizard, the strength and experience of the Lizard team, and the increasing investor demand for global small caps.”

Leah Zell said, “The Pengana investment provides Lizard with additional resources and management capability to thrive in coming years. I look forward to working with the Pengana team on building out the firm and ensuring long term sustainability. Global Small Caps is a highly sought-after asset class, with very few fund managers having substantial experience and long-term track records. In the current late stage of the economic cycle that has seen extraordinary growth from large cap stocks, investors are now looking to make structural changes to their portfolios, and global small caps should be a great beneficiary of this. Lizard, with its strong, decade-long track record is particularly well placed to benefit from this environment.”

Pengana will inject working capital into Lizard in order to grow and diversify the business, as well as provide Lizard with supporting services. Importantly, neither Leah nor any other member of the Lizard team will be selling equity to Pengana and all key team members remain committed to the business for the long term. The acquisition is scheduled to be completed on 1 January 2020.

The Lizard acquisition is not expected to have a material impact on Pengana financially or operationally; nor will it impact existing investments held by unitholders in the Pengana Global Small Companies Fund.

About Pengana Capital Group

Pengana Capital is a funds management group specialising in providing managed investments in both listed and unlisted equities. Our focus is on delivering distinct investment strategies targeting superior risk-adjusted returns for investors, with a focus on capital preservation.

Pengana Capital Group believes that alignment of interest between a fund manager and its investors is crucial. Our business and our funds are structured and managed within this framework.