DYNAMIC GROWTH

Dynamic growth is about:

- Being ahead of the curve

- Identifying forward-looking operational data points

- Finding where the company is going rather than where it has been

The Pengana Axiom International Fund invests in companies that are dynamically growing and changing for the better, more rapidly than generally expected and where the positive changes are not yet reflected in expectations or valuation.

The Global Equity Strategy seeks dynamic growth by concentrating its investments in global developed markets, and may also invest in companies located in emerging markets.

The investment manager is Axiom Investors, a Connecticut-based global equity fund manager formed in 1998 with over US$17billion in assets under management.

All-cap growth portfolio

- 40-70 holdings

- Position sizes limited to the greater of 8% or 1.5x the index

- Maximum weighting guidelines:*

- Sectors: 0% – 40%*

- Countries: 0% – 30%*

- Emerging markets: 0% – 25%

Dynamism factors

- Leading dynamic indicators influencing individual stocks

- Earnings dispersion

- Earnings revisions

- Analyst upgrades

- Valuation

- Earnings growth

Company position factors

- Market capitalization

- Competitive position

- Daily liquidity

- Index inclusion

- Volatility

- Country rating

Manage and adjust

- Continuous monitoring of investment thesis and expectations

- Adjust position size based on new data flows and re-ranks of position

- Expected holding period: 12-24 months

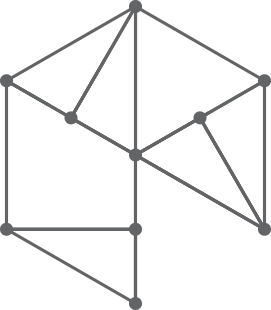

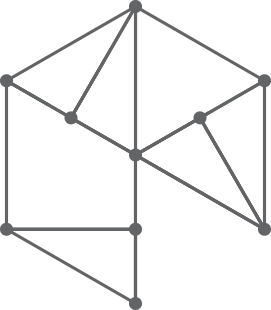

Consistent, empirical, forward-looking process

1. Identify

2. Analyze

3. Construct

4. Adjust

1. Identify

- 85% of ideas start with quantifiable operational accelerations

- Supplementary growth and revision screening

- 50%/50% idea generation from PMs and global sector analysts

- Primarily proprietary Axiom research

- External sources used to calibrate expectations

2. Analyze

- Holistic assessment of all key stock drivers

- Calibrate operating fundamentals against market expectations

- Emphasis on positive change, high sustainable growth and

profitability, reasonable valuation - Consistent Axiom rating used across all strategies

3. Construct

- Ratings reflect risk and return and drive stock inclusion and sizing

- Emphasize diversified sources of alpha

- Transparent and systematic process using multiple data inputs and team perspectives

- Objective: High active share, reasonable tracking error, upside participation with downside protection

4.Adjust

- Hundreds of key driver data points captured daily in Axware database

- Entire team reviews performance and global developments daily

- Lead PM has final decision-making authority

- Ratings and weights adjusted as risk/return evolves

- Expected 12- to 24-month holding period

Communication and Collaboration

One location, one team

Daily investment team meeting

- Rank and score data

- Several hundred data points scored daily in Axware

Weekly meeting

- New ideas

- Portfolio reviews

- Sector reviews

Quarterly

- Earnings previews and reviews

- Strategy reviews

Semi-annual/annual

- Evaluate client outcomes and detailed attribution

ESG & ETHICAL INVESTING WITHOUT COMPROMISING RETURNS

Axiom believes that ESG factors are material to achieving investment outperformance and managing investment risk. Therefore, it has integrated ESG into its dynamic growth investment process since its inception in 1998. It believes that significant investment opportunities arise when companies improve their ESG characteristics.

To advance favourable outcomes, the investment team incorporates ESG considerations into the regular engagement with company management. Axiom evaluates progress on an ongoing basis and incorporates those developments into the proprietary risk and return rating, which influences the position sizing and proxy voting.

Axiom is a signatory to the Principles for Responsible Investing (PRI) and has a dedicated ESG leadership committee, composed of senior executives from every functional area of the firm, that works across the organization to ensure that everyone is advancing the ESG policies and practices.

The Fund’s ethical investment policy is implemented by Axiom with oversight from Pengana. The ethical policy states the permissible extent of an investee company’s material business involvement* in screened activities. Any company that does not meet the requirements of the screen is removed from the investable universe.

OUR ETHICAL FRAMEWORK

*Material business involvement is generally considered to be over 5% of production of, or 15% aggregate revenue from, the production, distribution and retail of the screened product/service. For thresholds on each specific screen please refer to the Responsible Investment Policy HERE

Performance Since Strategy Inception

- CHART

- TABLE

- UNIT PRICES

Net performance figures are shown after all fees and expenses, and assume reinvestment of distributions. Performance figures are calculated using net asset values after all fees and expenses, and assume reinvestment of distributions. No allowance has been made for buy/sell spreads. Past performance is not a reliable indicator of future performance. The value of the investment can go up or down.

Prior to June 2021, the Axiom Global Equity Strategy performance (shown in the shaded area) includes the strategy performance simulated by Pengana from the monthly gross returns of the Axiom Global Equity strategy. This simulation was done by: 1) the conversion of US-denominated gross returns to AUD, 2) applying the fee structure of the stated class. The simulation does not include the Pengana ethical screen. From June 2021 the strategy performance is the performance of the Pengana Axiom International Fund.

Net performance figures are shown after all fees and expenses, and assume reinvestment of distributions. Performance figures are calculated using net asset values after all fees and expenses, and assume reinvestment of distributions. No allowance has been made for buy/sell spreads. Past performance is not a reliable indicator of future performance. The value of the investment can go up or down.

Prior to June 2021, the Axiom Global Equity Strategy performance (shown in the shaded area) includes the strategy performance simulated by Pengana from the monthly gross returns of the Axiom Global Equity strategy. This simulation was done by: 1) the conversion of US-denominated gross returns to AUD, 2) applying the fee structure of the stated class. The simulation does not include the Pengana ethical screen. From June 2021 the strategy performance is the performance of the Pengana Axiom International Ethical Fund.

For Pengana Axiom International Fund (Hedged): From 4th June 2021, the capital component of the foreign currency exposure for the Pengana Axiom International Fund (hedged) was hedged back to Australian dollars.

Pengana Axiom International Fund

PERFORMANCE AT 28 Nov 2025

The Class was established in 1 July 2017. From June 2021 Axiom was appointed as the investment manager for the Fund.

| 1M | 1Y | 2Y | 3Y |

Since

Axiom Appointed June 20211 |

5Y |

Since Fund

Inception July 20172 |

Since Strategy

Inception July 20043 |

|

|---|---|---|---|---|---|---|---|---|

| Fund: APIR (HOW0002AU)1,2

Managed by Axiom from June 2021

|

-2.6% | 7.9% | 19.5% | 20.0% | 11.0% | 10.7% | 11.7% | |

| Current Strategy (Partial Simulation)4

Axiom Global Equity Strategy

|

11.2% | 13.9% | 9.1% | |||||

| Index5 | -0.2% | 17.4% | 22.8% | 19.5% | 13.8% | 14.6% | 13.6% | 8.9% |

Swipe horizontally to see all columns

* Performance for periods greater than 12 months are annualised. Net performance figures are shown after all fees and expenses, and assume reinvestment of distributions. No allowance has been made for buy/sell spreads. Past performance is not a reliable indicator of future performance, the value of investments can go up and down.

1. Axiom was appointed fund manager as of 5 May 2021. June 2021 represents the first full month of Axiom managing the Fund.

2. Inception date 1 July 2017. Performance shown in row labelled Fund (APIR HOW0002AU) is the continuous performance of both the current and previous strategies.

3. Axiom Global Equity Strategy inception 1 Jul 2004.

4. Prior to June 2021, the Axiom Global Equity Strategy performance (labeled ‘Current Strategy (Partial Simulation)’ and shown in the shaded area) includes the strategy performance simulated by Pengana from the monthly gross returns of the Axiom Global Equity strategy. This simulation was done by: 1) the conversion of US-denominated gross returns to AUD, 2) applying the fee structure of the stated class. The simulation does not include the Pengana ethical screen. From June 2021 the strategy performance is the performance of the Pengana Axiom International Fund.

5. MSCI All Country World Total Return Index in AUD.

Pengana Axiom International Fund (Hedged)1

PERFORMANCE AT 28 Nov 2025

The Class was established in 1 July 2017. From June 2021 Axiom was appointed as the investment manager for the Fund.

| 1M | 1Y | 2Y | 3Y |

Since

Axiom Appointed June 2021 |

5Y |

Since Fund

Inception July 20173 |

Since Strategy

Inception July 20044 |

|

|---|---|---|---|---|---|---|---|---|

| Fund: APIR (HHA0002AU)2,3

Managed by Axiom from June 2021

|

-2.5% | 6.4% | 17.3% | 17.5% | 6.3% | 6.4% | 9.0% | |

| Current Strategy (Partial Simulation)5

Axiom Global Equity Strategy

|

8.1% | 11.2% | 10.2% | |||||

| Index (Hedged)6 | 0.1% | 16.8% | 21.0% | 17.2% | 9.6% | 11.8% | 11.2% | 10.2% |

Swipe horizontally to see all columns

* Performance for periods greater than 12 months are annualised. Net performance figures are shown after all fees and expenses, and assume reinvestment of distributions. No allowance has been made for buy/sell spreads. Past performance is not a reliable indicator of future performance, the value of investments can go up and down

1. From 4 June 2021 the capital component of the foreign currency exposure for the Fund is hedged back to Australian dollars

2. Axiom was appointed fund manager as of 5 May 2021. June 2021 represents the first full month of Axiom managing the Fund

3. Inception date 1 July 2017. Performance shown in row labelled Fund (APIR HHA0002AU) is the continuous performance of both the current and previous strategies.

4. Axiom Global Equity Strategy inception 1 Jul 2004.

5. Prior to 1 June 2021, the Axiom Global Equity Strategy performance (labeled ‘Current Strategy (Partial Simulation)’ and shown in the shaded area) includes the strategy performance simulated by Pengana from the monthly gross USD returns of the Axiom Global Equity strategy. The Axiom Global Equity Strategy performance does not include the Pengana ethical screen

6. Prior to 4 June 2021 hedged performance has been simulated by Pengana for both the Fund and Index. This was done by: 1) using 3 month rolling forwards to hedge movements in the AUD/USD spot rate, and 2) deducting the Pengana International Ethical Fund (Hedged) management fee of 1.35% p.a. from the Fund’s performance.

7. From 4 June 2021, index performance is from the MSCI All Country World Total Return in AUD (Hedged). Prior to 4 June 2021, index performance is simulated from the MSCI All Country World Total Return in USD

Pengana Axiom International Fund (Hedged)

Swipe horizontally to see all columns

PORTFOLIO

Total portfolio holdings as at 28 Nov 2025: 42

- TOP HOLDINGS (alphabetically)

- Portfolio breakdown

Allocations may not sum to 100% due to rounding.

Fund Facts

MINIMUM INITIAL INVESTMENT:

$10,000

RECOMMENDED TIMEFRAME:

5 years or more

BENCHMARK:

MSCI All Country World Total Return Index (net) in $A

MANAGEMENT FEE:*

1.35% p.a.

PERFORMANCE FEE:*

Nil

BUY/SELL SPREAD:

0.15% on both applications and redemptions

0.25% on both applications and redemptions (Hedged)

ENTRY/ EXIT FEES:

Nil

FUND PRICING:

Daily

DISTRIBUTION FREQUENCY:

Twice yearly (June and December)

TYPICAL NUMBER OF STOCKS:

40 – 70

APIR CODE:

HOW0002AU

HHA0002AU (Hedged)

*Fees are stated inclusive of GST and net of RITC. For more information, refer to the Fund’s product disclosure statement available under the Reports & Resources section.

PLATFORM AVAILABILITY

- Asgard eWrap

- BT Investment Wrap

- BT Panorama

- BT Superwrap

- CFS Edge – IDPS/Super/Pension

- Centric – IDPS

- Hub24

- IOOF Grow Wrap

- Macquarie Wrap – IDPS

- Mason Stevens – IDPS

- Mason Stevens – Super (Hedged)

- Netwealth

- Powerwrap

REPORTS AND RESOURCES

- Monthly Reports

- Financial Reports

- Responsible Investment

- Portfolio Holdings

- PDS & TMD

- Important Information

Axiom International Funds

Axiom International Funds (Hedged)

- Annual Financial Report June 2025

- Annual Financial Report June 2025 Hedged

- Annual Financial Report June 2024 Axiom International Fund (Hedged)

- Annual Financial Report June 2024 Axiom International Fund

- Half Year Financial Report 31 Dec 2023 Pengana Axiom International Fund

- Half Year Financial Report 31 Dec 2023 Pengana Axiom International Fund (Hedged)

- Annual Financial Report to 30 June 2023 Axiom International Funds (Unhedged)

- Annual Financial Report to 30 June 2023 Axiom International Funds (Hedged)

- Half-year Financial Report 31 December 2022Pengana Axiom International Fund

- Half-year Financial Report 31 December 2022Pengana Axiom International Fund (Hedged)

- Annual Financial Report to 30 June 2022 Axiom International Funds

- Annual Financial Report to 30 June 2022 Axiom International Funds (Hedged)

- Half Year Financial Report to 31 December 2021 Axiom International Funds

- Half Year Financial Report to 31 December 2021 Axiom International Funds (Hedged)

- Annual Financial Report to 30 June 2021 Axiom International Funds

- Annual Financial Report to 30 June 2021 Axiom International Funds (Hedged)

- Sep 25 - Notice regarding changes made in the Product Disclosure Statements and Product Guides

- May 25 - Notice regarding changes made in the Axiom PDSs and PGs dated 22 May 25

- May 25 - Notice Re Members rights to elect how to receive documents

- Jan 24 - Notice re changes made in PDS and PG dated 100124 for Axiom and Axiom Hedged

- May 23 - Notice Re Change of Compliance Plan Auditor

- March 23 - Notice Re Change of Auditor

- Upcoming Fee Reductions

NEWS AND INSIGHTS

Four risks that investors should watch in 2025

Global equities have just delivered a second year of stellar gains, but a range of investment risks may bring more...

Should investors worry about tariffs?

The prospect of the new Trump administration raising tariffs may have helped push up interest rate expectations, bond yields and...