A high conviction A-REIT fund with an ESG focus.

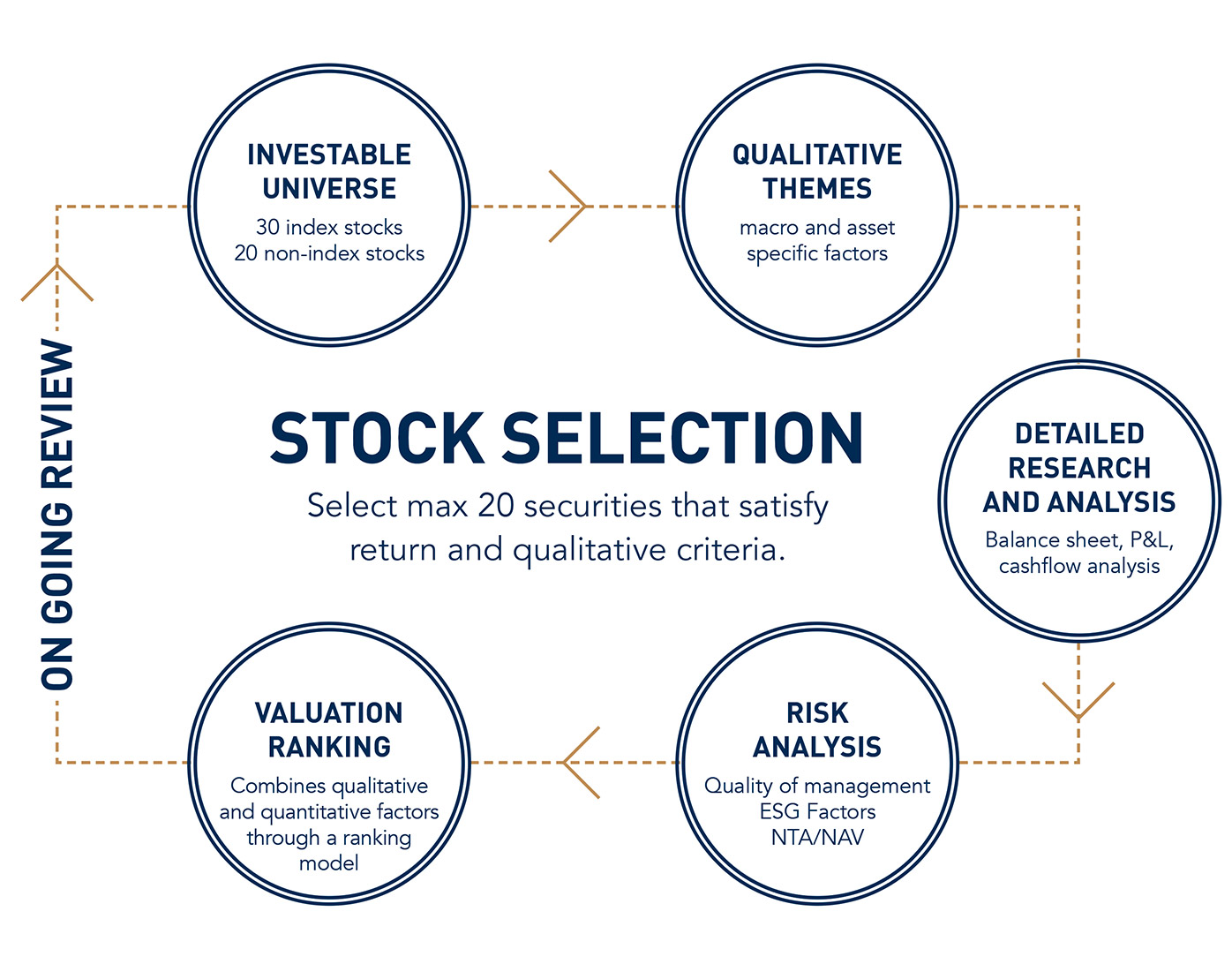

The Pengana High Conviction Property Securities Fund believes each security has an underlying or intrinsic value and that securities become mispriced at times relative to their value and each other, and seeks to exploit such market inefficiencies by employing an active, value-based investment style to capture the underlying cashflows generated from real estate assets and/or real estate businesses.

We believe that responsible investing is important to generate long-term sustainable returns. Incorporating ESG factors alongside financial measures provides a complete view of the risk/return characteristics of our property investments.

All positions are high conviction and assessed on a risk-reward basis, resulting in a concentrated portfolio of 10-20 securities.

THE FUND IS FOCUSED ON

CAPITAL SECURITY

Transparent NTA valuations are easily verified

INCOME YIELD

A-REITs have reliable income derived from assets with long term leases

SUSTAINABLE GROWTH

Rental growth indexed to CPI. A concentrated portfolio enables investment in best-positioned assets and sectors at any point in time

LIQUIDITY

Daily priced A-REITs with market capitalisation > $50m

SOUND ESG

A-REITs rank highly on National Australian Built Environment Rating System (NABERS) initiatives. The Fund only invests in proven management teams that have demonstrated good corporate governance

ESG factors in the property sector

| |

Environment(relating to the company, its tenants and suppliers) |

Social(relating to the company, its tenants and suppliers) |

Governance(relating to the company) |

| Factors |

|

|

|

| Measures |

|

|

|

| Policies & targets |

|

|

|

Swipe horizontally to see all columns

PERFORMANCE

- CHART

- TABLE

- UNIT PRICES

Net performance figures are shown after all fees and expenses, and assume reinvestment of distributions. The Fund incepted on March 11th 2020. Index performance calculations include a complete month’s performance for March 2020. Performance figures are calculated using net asset values after all fees and expenses, and assume reinvestment of distributions. No allowance has been made for buy/sell spreads. Please refer to the PDS for information regarding risks. Past performance is not a reliable indicator of future performance, the value of investments can go up and down.

Inception 11 March 2020

PERFORMANCE AT 30 Jan 2026

| 1 MTH | 1 YEAR | 2 YEARS P.A. | 3 YEARS P.A. | SINCE INCEPTION P.A. | |

|---|---|---|---|---|---|

| High Conviction Property Securities Fund | -2.1% | 3.9% | 13.1% | 12.4% | 9.7% |

| S&P/ASX 300 A-REIT (AUD) TR Index | -2.7% | 2.0% | 11.3% | 10.7% | 6.0% |

Swipe horizontally to see all columns

Net performance figures are shown after all fees and expenses, and assume reinvestment of distributions. The Fund incepted on March 11th 2020. Index performance calculations include a complete month’s performance for March 2020. Performance figures are calculated using net asset values after all fees and expenses, and assume reinvestment of distributions. No allowance has been made for buy/sell spreads. Please refer to the PDS for information regarding risks. Past performance is not a reliable indicator of future performance, the value of investments can go up and down.

Inception 11 March 2020

PORTFOLIO

Total portfolio holdings as at 30 Jan 2026: 14

- TOP HOLDINGS (alphabetically)

- Portfolio breakdown

Allocations may not sum to 100% due to rounding.

Fund Facts

MINIMUM INVESTMENT

$10,000

RECOMMENDED TIMEFRAME

5 or more years

INCEPTION DATE

11 March 2020

MANAGEMENT FEE*

0.70% per annum

PERFORMANCE FEE*

Performance fee of 15% (including GST net of RITC) of any return of the Class greater than the return of the Index after deduction of the management fee and adjusted for applications, redemptions and distributions to investors.

BUY/SELL SPREAD:

0.25%

ENTRY/ EXIT FEES:

Nil

DISTRIBUTION FREQUENCY:

Quarterly

TYPICAL NUMBER OF STOCKS:

Typically less than 20

APIR CODE:

PCL8246AU

*Fees are stated inclusive of GST and net of RITC. For more information, refer to the Fund’s product disclosure statement available under the Reports & Resources section.

PLATFORM AVAILABILITY

- AMP North

- BT Panorama

- Centric

- Dash

- Hub24

- Macquarie Wrap

- Mason Stevens

- Netwealth

- Praemium

REPORTS AND RESOURCES

- Monthly Reports

- FINANCIAL REPORTS

- ESG

- Portfolio Holdings

- PDS & TMD

- Notices

- January 2026 - REITs remain on track despite rising rates

- December 2025 - Winners and losers of 2025 and what to expect in 2026

- November 2025 - Why Rising Rates Won’t Sink REITs

- October 2025 - Strong fundamentals to drive earnings growth

- September 2025 - Confidence returns to housing, despite rate cuts moderating

- August 2025 - FY25 was good, FY26 is set to be even better

- July 2025 - A-REIT- Best shape in 5 years

- June 2025 - A strong finish to the financial year amidst market volatility

- May 2025 - What we’re backing in FY26

- April 2025 - AREITs - A safe haven amongst global uncertainties

- March 2025 - How the real estate sector is faring through turbulent times

- February 2025 - Who can grow earnings?

- January 2025 - Setting the foundation for growth

- December 2024 - A-REITs turning the corner as interest rate cuts commence

- November 2024 - Can REITs outperform in a higher for a little longer environment?

- October 2024 - Quarterly updates setting the scene for FY25

- September 2024 - An inflection point for REITs

- August 2024 - Winners and losers of FY24 Reporting season and our outlook

NEWS AND INSIGHTS

Silver lining for property stocks amid uncertain outlook for rates

Prospects for earnings growth from listed property stocks this year remain remarkably rosy despite a volatile outlook for interest rates...

Winners and Losers of 2025: A Turning Point for Australian Property

After two years of momentum, 2025 proved to be a year of divergence for Australian-listed property. Shifting interest rate expectations,...

ESG Isn’t a “Nice to Have” – It’s a Business Imperative

ESG is no longer just a feel-good label. Why? Because ignoring ESG today means ignoring risk, reputation, and returns tomorrow....